US stocks have made a significant recovery overnight, with Wall Street showing strong gains. The ASX futures suggest that the Australian market might follow suit, indicating a potentially positive day for investors and job seekers alike.

Oil prices have seen a slight decline after reports surfaced that Iran might be open to reopening negotiations. This development could have implications for global markets and, by extension, the Australian economy.

Market Snapshot

- Dow Jones: +0.8% to 42,515 points

- S&P 500: +0.9% to 6,033 points

- Nasdaq: +1.5% to 19,701 points

- ASX 200 futures: +0.06%, +5 points to 8,565 points

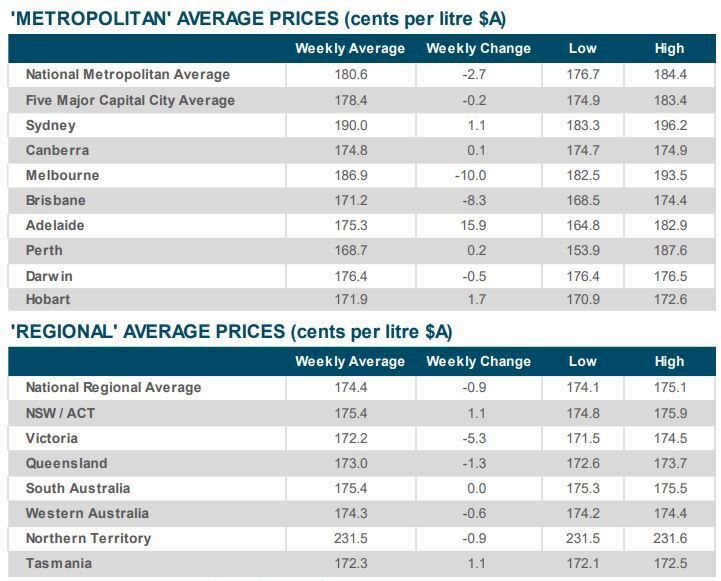

Petrol prices in Australia have decreased by 2.1 cents per litre in the past week, bringing the national average to 178.6 cents. However, this data precedes the recent spike in crude oil prices due to escalating tensions in the Middle East.

Australia's global competitiveness ranking has dropped from 13th to 18th, according to the IMD World Competitiveness Yearbook 2025. This decline is attributed to slow economic growth and a decrease in business efficiency.

Key factors affecting Australia's ranking:

- Economic performance fell from 7th to 16th

- Business efficiency dropped from 22nd to 37th

- Real GDP growth per capita fell from 20th to 60th

The Reserve Bank of Australia is considering publishing unattributed votes from its monetary policy committee when there's no consensus on interest rate decisions. This move aims to increase transparency in the bank's decision-making process.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!